| | | |||||||

Date: | | | April | |||||

Time: | | 4:00 | ||||||

Place: | | 3421 Hillview Avenue, Palo Alto, California | ||||||

Record Date: | | | February 22, 2024 | |||||

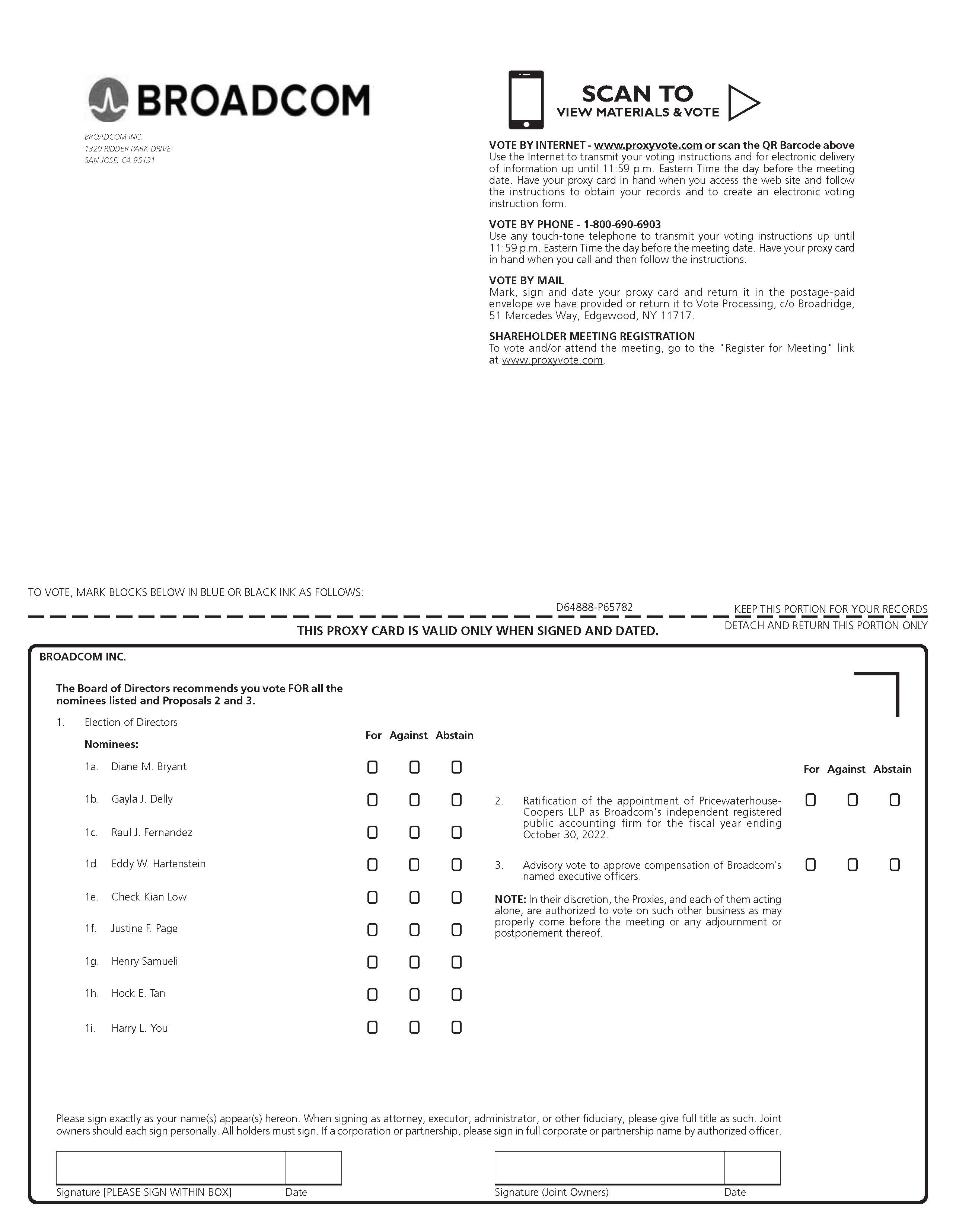

Items of | | 1. To elect each of the nine director nominees | ||||||

| | 2. To ratify the appointment of PricewaterhouseCoopers LLP | |||||||

| | 3. To hold an advisory vote to approve the | |||||||

| | 4. To transact any other business as may properly come before the meeting or any postponements or adjournments to the meeting. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | |

BROADCOM INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | | | ||||||

No fee required. | ||||||||

☐ | | | Fee paid previously with preliminary materials. | |||||

☐ | | | Fee computed on table | |||||

NOTICE OF 20222024 ANNUAL MEETING OF STOCKHOLDERS

Vote via the Internet You can vote your shares online at www.proxyvote.com |

Vote by Telephone In the U.S. or Canada, you can vote by calling (800) 690-6903 |

Vote by Mail Complete, sign, date and return your proxy card in the postage- paid envelope |

These items of business are described more fully in the accompanying Proxy Statement. On or about February 18, 2022,26, 2024, we are mailing to most of Broadcom’s common stockholders at the close of business on the Record Date a noticeNotice of availabilityInternet Availability of proxy materials instead of a paper copy of the proxy materials.Proxy Materials.

Your vote is important. Regardless of whether you plan to participate in the Annual Meeting, we hope you will vote as soon as possible. Voting willpossible via the Internet, by telephone or by mail to ensure you are represented at the Annual Meeting, regardlessMeeting. Instructions for using these voting methods are set forth on the proxy card or the Notice of whether you plan to attend theInternet Availability of Proxy Materials.

Important notice of internet availability of proxy materials:

The notice of meeting, Proxy Statement and 2023 Annual Meeting. You may cast your vote over the Internet, by telephone, by mail or during the Annual Meeting.Report are available at https://investors.broadcom.com.

By Order of the Board,

Hock E. Tan

Director, President and Chief Executive Officer

February 18, 202226, 2024

This proxy statement contains forward-looking statements. We havestatements that are based these forward-looking statements on our current expectations and projections about future events. Forward-lookingThese forward-looking statements contained in this proxy statement should be considered in light of the many uncertainties that affect our business and specifically those factors in our filings filed with the Securities and Exchange Commission, such as those discussed under the heading “Risk Factors,”Factors” in our Annual Report on Form 10-K for ourthe fiscal year ended October 31, 202129, 2023 and as may be updated in our subsequent filings.filings filed with the Securities and Exchange Commission.

| | |  | | | ||||

i | ||||||||

Dear Broadcom stockholders:

On behalf of the entire Board, I want to thank you for your continued investment in and support of Broadcom. I also want to provide you with several updates in connection with the upcoming Annual Meeting.

Fiscal 2023 Financial Performance

In fiscal 2023, Broadcom generated record revenue, operating income and free cash flow. This strong performance reflects the dynamic expansion of our footprint in generative AI, growth of our semiconductor solutions business despite the cyclical slowdown in the semiconductor industry and continued expansion of our infrastructure software business.

We are proud of our continued growth and top-of-the-market performance. We are ranked third among S&P 500 companies for total stockholder return over the past ten years and we became the 10th-most valuable U.S. company based on market capitalization in December 2023. More broadly, from Broadcom’s initial public offering in 2009 through fiscal 2023, we have increased our market capitalization value from $3.8 billion to $346.0 billion.

VMware Acquisition

We are thrilled to have completed the VMware acquisition in November 2023, which brings us closer to achieving our long-term strategic goal of building the world’s leading infrastructure technology company. Our executive officers demonstrated strong leadership and exerted tremendous effort in fiscal 2023 to complete this acquisition in the midst of a challenging regulatory and geopolitical environment.

Board Composition

In February 2024, the Board appointed Kenneth Hao as a member of the Board. Mr. Hao brings to the Board valuable experience as chairman and managing partner of Silver Lake and deep knowledge of the software industry at a time when integrating the VMware business and employees is a top priority for Broadcom.

Raul Fernandez has decided not to stand for re-election upon the expiration of his term at the Annual Meeting. We thank Mr. Fernandez for his invaluable contribution to Broadcom and the Board.

Succession Planning

We consider CEO and senior management succession planning to be one of the Board’s primary responsibilities and the Board is actively engaged in this area. We have a CEO succession plan in place that we believe would minimize disruption in our business and preserve operational continuity should the need arise to implement this plan.

Executive Compensation

The Board takes a thoughtful, disciplined and well-governed approach to executive compensation that is not a “one-size-fits-all” approach and reflects Broadcom’s transformation from a semiconductor company into a leading infrastructure technology company. Broadcom also operates in industries where there is fierce competition for critical talent and increasing interest in our CEO and executives due to their successful track record.

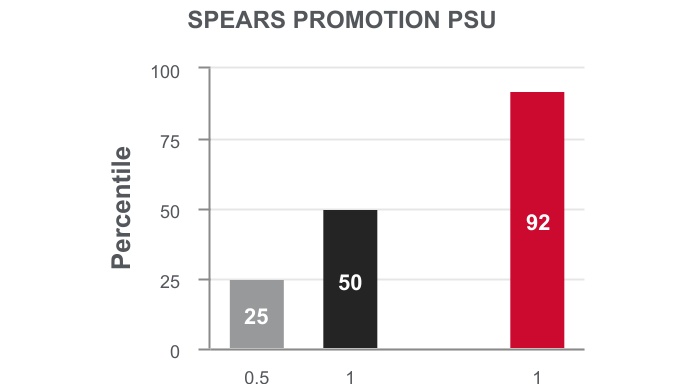

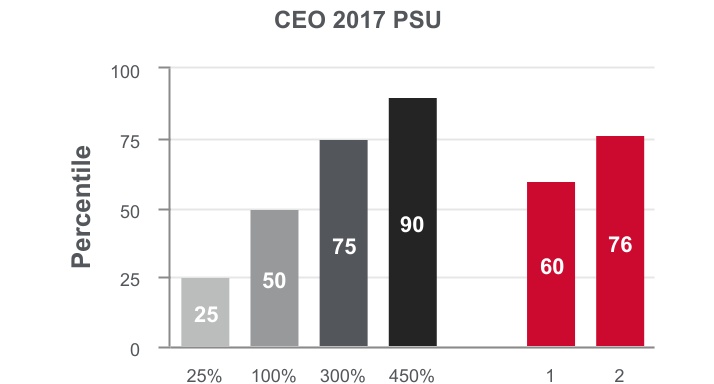

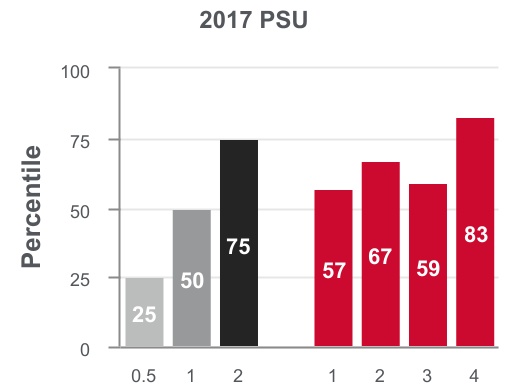

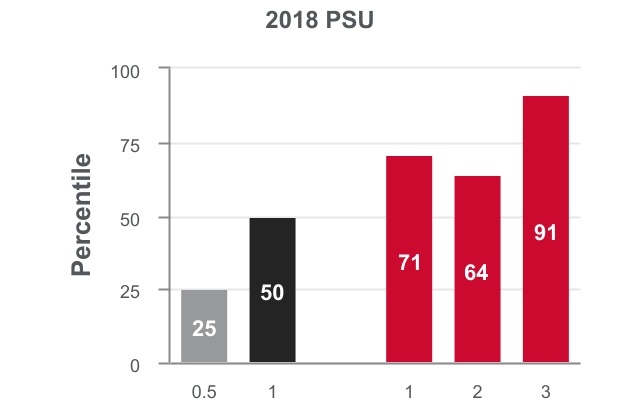

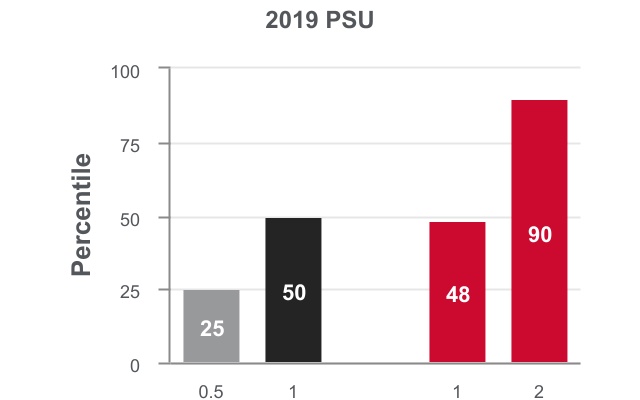

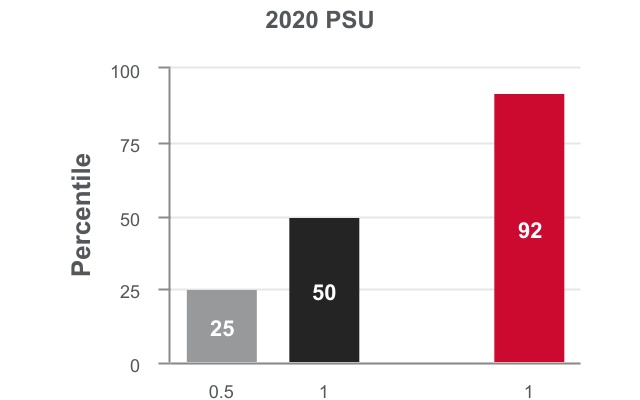

To retain and motivate Hock Tan, President and CEO, and Charlie Kawwas, President, Semiconductor Solutions Group, the independent members of the Board granted Mr. Tan and the Compensation Committee granted Dr. Kawwas performance stock unit (PSU) awards in fiscal 2023 that require (i) achievement of formidable stock price performance hurdles and (ii) continued service over a five-year vesting period.

Mr. Tan’s fiscal 2023 PSU award was front-loaded to cover the market-based value of both his annual cash and long-term incentive opportunities over a period of five years. Dr. Kawwas’ fiscal 2023 PSU award was also front-loaded to cover the market-based value of his annual long-term incentive opportunities over a period of five years. The annualized GAAP value of these PSU awards was in line with our compensation peer group benchmarks. During the five-year vesting period, we do not intend to grant annual equity awards to Mr. Tan and Dr. Kawwas and Mr. Tan will not be eligible to receive annual cash incentive payouts because these PSU awards were front-loaded.

| | |  | | | 1 |

These PSU awards are 100% at risk and deliver value to Mr. Tan and Dr. Kawwas only if our stockholders receive significant and sustained value appreciation. Additional disclosure on the methodology and design of these PSU awards is provided below in “Compensation Discussion and Analysis.”

Stockholder Engagement and Responsiveness

Although we have a steady history of robust engagement with our stockholders, the level of support received for our Say-on-Pay proposal at last year’s annual meeting indicated that we should increase the level of our stockholder engagement on executive compensation and we have intentionally done so.

At these meetings, our stockholders acknowledged our executive officers’ extraordinary performance in growing stockholder value, but also provided feedback on the incremental PSU award granted to Mr. Tan in fiscal 2022. In response to the feedback, the Board and the Compensation Committee have made commitments regarding special performance awards outside the regular annual equity grant cycle. More information about our response is provided below in “Stockholder Engagement.”

Your continued support and vote is important to us. We hope that our actions convey an unwavering pursuit of sustainable future excellence consistent with expectations built on our remarkable achievements to date. We encourage you to read this Proxy Statement and vote your shares.

Sincerely,

Henry Samueli, Ph.D.

Chairman of the Board

2 | | |  |

Your proxy is being solicited by the Board of Directors of Broadcom Inc. (the “Board”) in connection with the 20222024 Annual Meeting of Stockholders (the “Annual Meeting”). We are making the Notice of Internet Availability of Proxy Materials (the “Internet Notice”), this proxy statement (the “Proxy Statement”) andwith the accompanying proxy card and our Annual Report on Form 10-K (the “2021 Annual Report”) for ourthe fiscal year ended October 31, 2021 (“Fiscal Year 2021”29, 2023 (the “2023 Annual Report”) available to common stockholders at the close of business on the Record DateFebruary 22, 2024 (the “Record Date”) on or about February 18, 2022.26, 2024. This summary highlights information contained elsewhere in this Proxy Statement. We encourage you to review the entire Proxy Statement before voting.

Unless the context otherwise requires, references in this Proxy Statement to “Broadcom,” “we,” “our,” “us” and similar terms are to Broadcom Inc.

PROPOSALS AND BOARD RECOMMENDATIONS

Proposal | | | Board Recommendation | | | Page | |||

1. | | | To elect each of the nine director nominees until the next annual meeting of stockholders or until their successors have been elected | | | For each director nominee | | | |

2. | | | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of Broadcom for the fiscal year ending November 3, 2024 | | | For | | | |

3. | | | To hold an advisory vote to approve the named executive officer compensation | | | For | | | |

Name | | | Independent | |||||

| |  | |||||||

| |  | |||||||

| |  | |||||||

|  |  | ||||||

| Eddy W. Hartenstein (Lead Independent Director) | |  | |||||||||||||||

Check Kian Low | |  | |||||||||||||||

Justine F. Page |  | ||||||||||||||||

Henry Samueli, Ph.D. (Chairman of the Board) | | |  | ||||||||||||||

Hock E. Tan (President & | | | |||||||||||||||

Harry L. You |  | ||||||||||||||||

| ||

| Board Diversity Matrix |   | ||||||||||||||||

| Total Number of Directors | 9 | ||||||||||||||||

| Gender Diversity | Female | Male | Non-Binary | Did Not Disclose | |||||||||||||

| Directors | 3 | 6 | — | — | |||||||||||||

| Demographic Background | |||||||||||||||||

| African American or Black | — | — | — | — | |||||||||||||

| Alaskan Native or Native American | — | — | — | — | |||||||||||||

| Asian | — | 3 | — | — | |||||||||||||

| Hispanic or Latinx | — | 1 | — | — | |||||||||||||

| White | 3 | 2 | — | — | |||||||||||||

| Two or More Races or Ethnicities | — | — | — | — | |||||||||||||

| LGBTQ+ | — | ||||||||||||||||

| Did Not Disclose | — | ||||||||||||||||

See “Board of Directors” below for more information about the Director Nominees.

FISCAL 2023 FINANCIAL HIGHLIGHTS

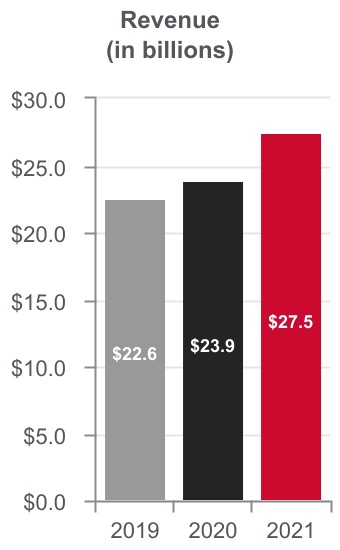

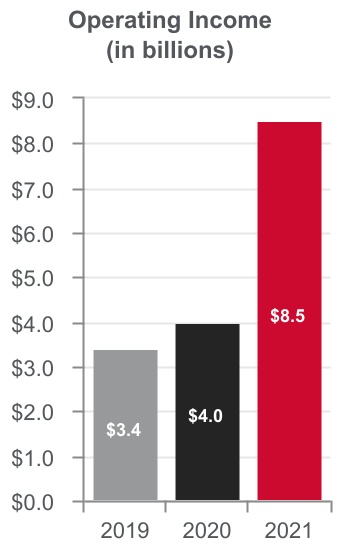

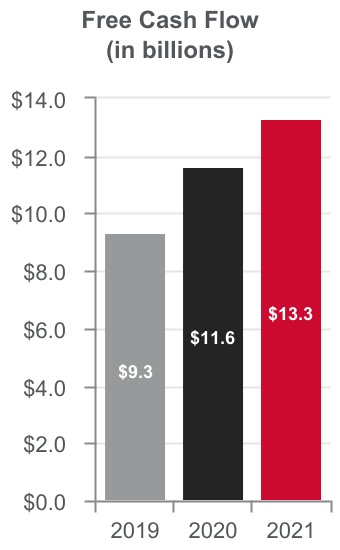

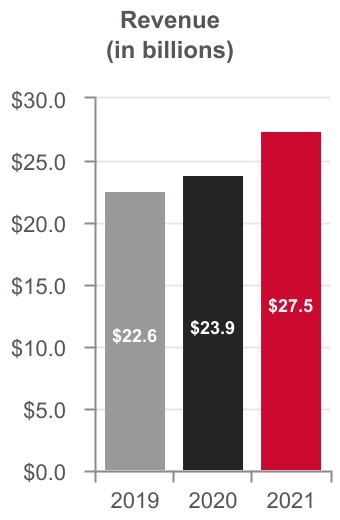

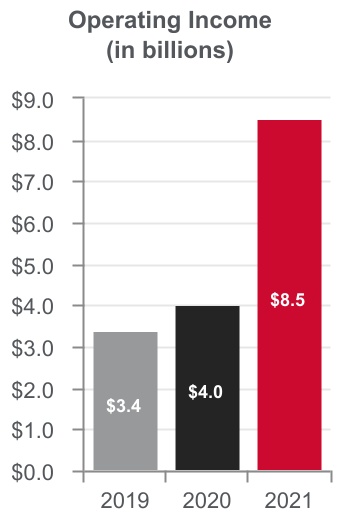

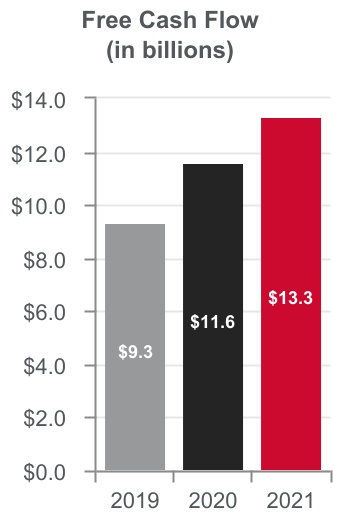

In fiscal 2023, we achieved record revenue of $35.8 billion, operating income of $16.2 billion and free cash flow of $17.6 billion despite the cyclical slowdown in the semiconductor industry. We also returned to our stockholders an aggregate of $13.5 billion via cash dividends and our stock repurchase program.

| | |  | | | ||||

3 | ||||||||

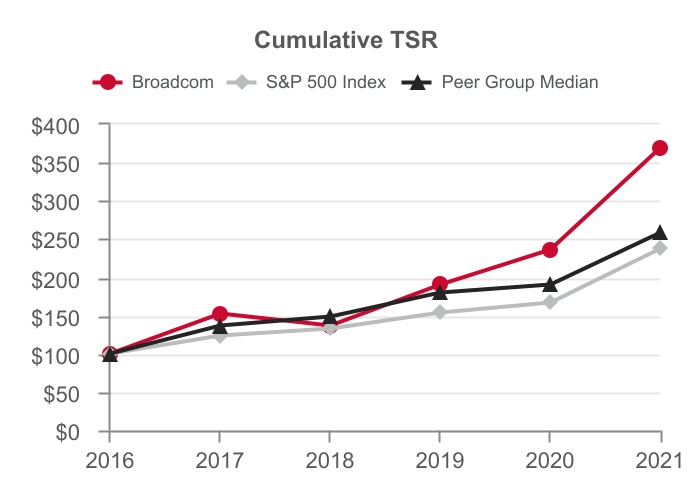

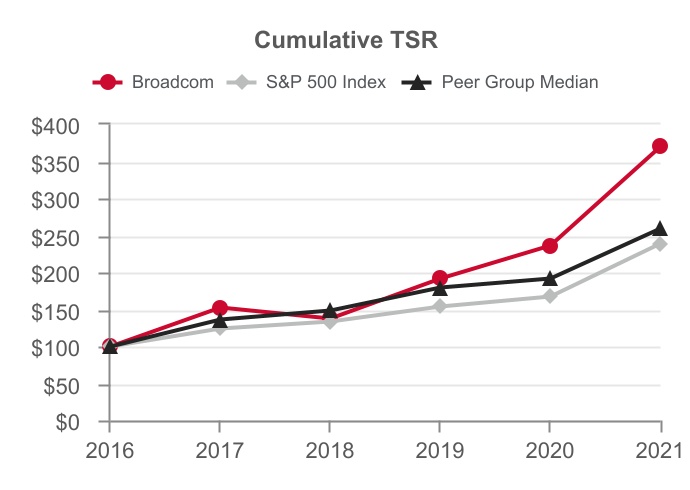

Total Stockholder Return and Return of Capital

Our total stockholder return (“TSR”) continues to significantly outperform the S&P 500 and our compensation peer group. Over the five fiscal year period through 2023, we delivered TSR of 351% and our market capitalization increased from $103.6 billion to $346.0 billion.

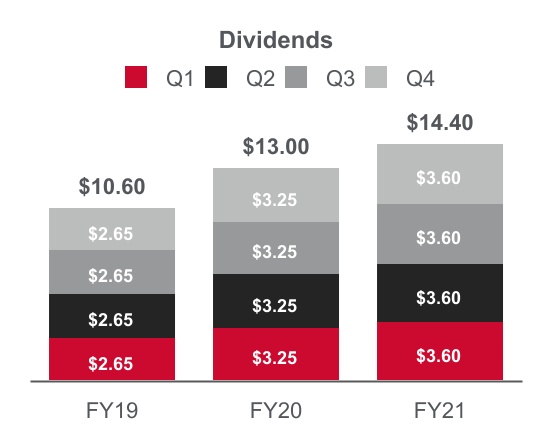

In addition, our strong cash flow in fiscal 2022 enabled us to return an aggregate of $13.5 billion to our stockholders during fiscal 2023, consisting of $7.7 billion in cash dividends and $5.8 billion under our stock repurchase program. We also paid $1.9 billion for the elimination of shares withheld to cover employee withholding taxes due upon the vesting of net settled equity awards. Our strong free cash flow in fiscal 2023 enabled us to increase our quarterly common stock dividend to $5.25 per share in our first quarter of fiscal 2024, an increase of 14% over the quarterly dividend paid in fiscal 2023.

| | |  |

* TSR assumes $100 investment in Broadcom common stock on the last trading day of fiscal 2018 and reinvestment of dividends.

Financial Performance

* See Appendix A for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures.

4 | | |  |

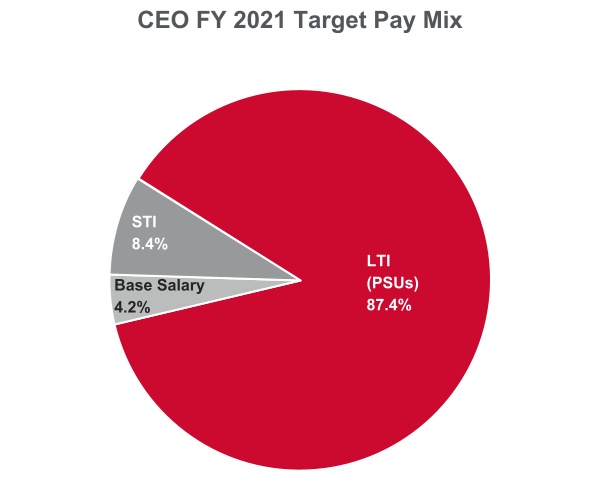

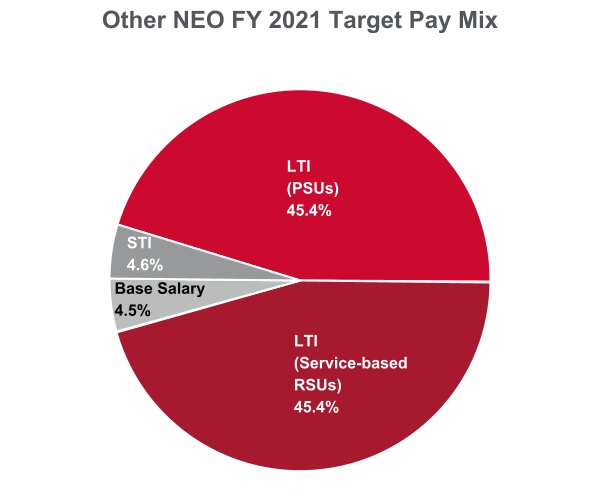

FISCAL 2023 NAMED EXECUTIVE OFFICER COMPENSATION

Our executive compensation program is designed to reward our executive officers for growing and sustaining stockholder value consistent with our strategic plan, align the interests of our executive officers with the interests of our stockholders, and attract, motivate and retain critical talent in a highly competitive talent market.

Consistent with the philosophy and objectives of our executive compensation program, 96% of our Chief Executive Officer’s (“CEO”) and 94% of our other named executive officers’ (“NEOs”) average target total direct compensation in fiscal 2023 is comprised of variable compensation with a majority tied to stock price, as shown in the charts below.

The short-term incentives and the long-term incentives in the form of performance stock unit (“PSU”) awards granted to our NEOs in fiscal 2023 were subject to challenging and rigorous goals to achieve record financial results and significantly increase stockholder value.

See “Compensation Discussion and Analysis — Elements of Fiscal 2023 Executive Compensation Program — Long-Term Incentive Compensation” below for more information about the equity awards granted to our NEOs in fiscal 2023.

| | |  | | | 5 |

We are committed to strong corporate governance and have designed our corporate governance framework to support the long-term interests of our stockholders, as well as our workforce, customers and communities. Some of our key governance practices include the following:

| | | Proxy access | | |  | | | Annual review of Board refreshment and composition | ||

| |||||||||||

Ability to call special meetings by two or more stockholders holding at least 10% of outstanding shares |  | | | Separate Chairman and CEO roles, with a Lead Independent Director | |||||||

| | | No supermajority voting requirements for bylaw amendments | ||||||||

| | Strong independent Board — | |||||||||

| | | No “poison pill” | | |  | | | Annual election of all directors | ||

| | | Annual say-on-pay vote |  | | | Majority vote for directors in uncontested election | ||||

| | | Robust stock ownership guidelines for all executive officers and directors | | |  | | | Independent directors regularly meet in executive session | ||

| | | Anti-hedging and anti-pledging policy for employees and directors | ||||||||

| |||||||||||

Active CEO and senior | |||||||||||

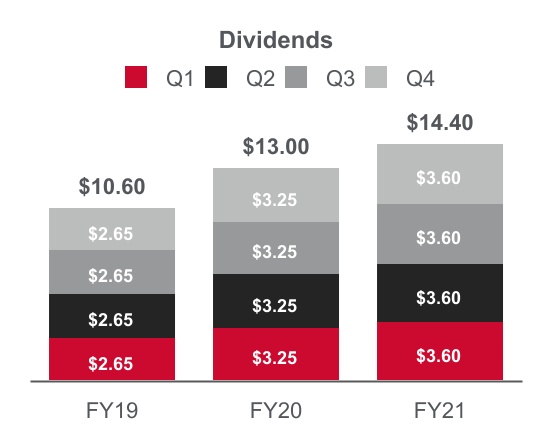

| Dividend Increase YoY% | 23% | 11% | ||||||||||||

| | | | |  | | | Annual Board and committee evaluations | |||

CODE OF ETHICS AND BUSINESS CONDUCT

A copy of the Code of Ethics is available in the “Investor Center—Center — Corporate Governance—Governance — Documents” section of our website or upon request to: Investor Relations, Broadcom Inc., 1320 Ridder Park Drive, San Jose,3421 Hillview Avenue, Palo Alto, California 9513194304.

Our Board has adopted the Corporate Governance Guidelines that coverscover various topics relating to our Board and its activities. A copy of the Corporate Governance Guidelines is available in the “Investor Center—Center — Corporate Governance—Governance — Documents” section of our website or upon request to: Investor Relations, Broadcom Inc., 1320 Ridder Park Drive, San Jose,3421 Hillview Avenue, Palo Alto, California 95131.

94304. Some of the governance best practices included in the Corporate Governance Guidelines are as follows:set forth below.

To ensure that our directors are not over-committed and have adequatesufficient time to fulfill their duties and responsibilities on our Board effectively, directors may not serve on more than four other public company boards without prior approval, except that a director who also serves as the chief executive officer of a public company should not serve on more than two public company boards in addition to our Board. The Nominating, Environmental, Social and Governance Committee (the “NESG Committee”) regularly reviews the commitments of our directors, including the number of other public company directorships.

When considering any such requests to serve on additional public company boards, our Board, with the NESG Committee, carefully takes into considerationreviews such director’s prior dedication of,time and attention to our Board and ability to continue to dedicate sufficient time to fulfill the responsibilities required as a member of our Board. Our Board also considers such director’s contributions to our Board, our full Board’s skill and that thediversity composition and whether such director’s service with the other public company boards does not and will not impact service on our Board.Board and the committees on which the director is a member, including if the other public company is a special purpose acquisition company.

6 | | |  |

Resignation Offered with Significant Job Change

Any director who retires from or terminates his or her present employment or who materially changes his or her position is required to submit an offer of resignation as a director of our Board. This provides our Board the opportunity to evaluate whether the individual should continue to sit on our Board in light of the director’s new occupational status. Our Board, following review by the NESG Committee, may invite any such director to remain a director if our Board determines that continued access to such director’s knowledge, skills and experience is in the best interests of Broadcom and our stockholders.

Our Board does not currently believe that a mandatory retirement age for non-employee directors is necessary and that continued service by a particular director may be in the best interests of Broadcom and our stockholders. However, when a non-employee director reaches the age of 75 years, the director is required to offer such director’s resignation to our Board, to be effective as of the next annual meeting of stockholders. This allows our Board to evaluate the composition and needs of our Board and determine whether continued service of such director is in the best interests of Broadcom and our stockholders.stockholders, taking into consideration that it is important to have directors who understand our business, operations, technology, strategy and industry.

Position | | | Stock Ownership | ||

Non-Employee Director | | 5x Annual Cash Retainer | |||

CEO | | 6x Base Salary | |||

Other Executive Officers | |||||

| | 3x | ||||

Our non-employee directors and executive officers are expected to satisfy the applicable stock ownership guidelines within five years of the date on which they become a director or an executive officer and to hold at least such minimum value in shares of common stock while they remain a director or an executive officer.

Our insider trading policy prohibits our directors and employees, including our executive officers, from hedging or pledging our securities, making short sales or trading in derivative securities related to our securities.

CEO and Management Succession PlanningAND SENIOR MANAGEMENT SUCCESSION PLANNING

Our Board is actively engaged and involved in the CEO and senior management succession planning. Our Board reviews thediscusses CEO succession plan and potential successors to the CEO and senior managementplanning at least bi-annually. Our Board has developed an interim contingency and a longer-term CEO succession plan. The interim contingency plan would utilize internal candidates and become effective in the event our CEO unexpectedly becomes unable to perform his duties, in order to minimize disruption to the business and preserve operational continuity. The longer-term CEO succession plan is currently focused on the development of internal candidates, as well as on maintaining business and operational continuity. In addition, our Board, with our CEO and Vice President of Human Resources, regularly discussdiscusses senior management succession planning and reviewreviews the composition of senior management,management. Our Board reviews the qualifications and experience of the potential successors and the development priorities and achievements of the potential successors. Our Board also engages with the potential internal candidatessuccessors at least annually at Board meetings and in less formal settings.

| | |  | | | 7 |

CORPORATE SOCIAL RESPONSIBILITY

Our Board, through the Nominating, Environmental, Social and GovernanceNESG Committee, (“NESG Committee”), oversees our environment, climate, diversity and inclusion, governance and human rights and governance (“ESG”)in the supply chain matters, including our corporate social responsibility and sustainability program and initiatives. The NESG Committee receives quarterly updates from management on ESGthese matters and regularly updates theour Board.

In February 2024, we published our Environmental, Social and Governance Report for Fiscal Year 2021fiscal 2023 (the “ESG Report”“Report”). In our ESGthe Report, we discuss our Fiscal Year 2021 ESGfiscal 2023 corporate social responsibility and sustainability program and initiatives, including our products that help our customers with sustainability, our human rights program within our supply chain, our talented and dedicated workforce and our environmental impact. We also disclosed in the Report our progress in reducing our Scope 1 and Scope 2 greenhouse gas emissions in line with the UN Paris Agreement and Science Based Targets Initiative goal to limit global warming to 1.5º Celsius above pre-industrial levels.

We prepared our ESGthe Report leveraging the Global Reporting Initiative (GRI) Sustainability Reporting Standards (core option), the Sustainability Accounting Standards Board (SASB) Semiconductors and Software & IT Services Industry Standards and the framework developed by the Task Force on Climate-Related

Financial Disclosures (TCFD). Our ESG Report is reviewed by the full Board. For more

Additional information regardingabout our corporate social responsibility and sustainability program and initiatives see our ESGis in the Report, onwhich is located in the Corporate Citizenship and the Investor Center sections of our website. Our ESGThe Report and our website are not part of or incorporated by reference into the Proxy Statement.

STOCKHOLDER ENGAGEMENT

We increased our 2012 Stock Incentive Plan (the “2012 Plan”), executive management promotions, executive compensation, equity compensation, and ESG corporate social responsibility and sustainability.

We also continue to engage with our stockholders on the progress of our ESG corporate social responsibility and sustainability program and initiatives.

You may communicate with our Board at the following address:

Broadcom Inc.

c/o Chief Legal and Corporate Affairs Officer

Communications are distributed to our Board or to any individual director, as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unduly hostile, threatening, illegal or similarly unsuitable will be excluded, but will be made available to any director upon request.

8 | | |

|

Our Board oversees the conduct of our business by our senior management and risk management, provides guidance on our strategic and business planning, processes, is principally responsible for the succession planning for our key executives, including our CEO and senior management, and ensures that the long-term interests of stockholders are being served.

BOARD MEMBERSHIP

Mr. Fernandez is not standing for re-election and will serve on our Board until the Annual Meeting. At the Annual Meeting, the size of our Board will be reduced to nine directors.

DIRECTOR INDEPENDENCE

Our Board annually reviews the independence of each director and nominee and considers whether such individual has a material relationship with Broadcom that could compromise their ability to exercise independent judgment in carrying out their responsibilities. For the purposespurpose of assessing a director’s independence, our Board reviewed transactions and relationships between Broadcom and an entity where a director or nominee serves as a director, executive officer and/or is the beneficial owner, directly or indirectly, of such entity, or where a director or nominee for director serves on a non-employee advisory board of or in a non-employee advisory capacity to such an entity.

Our Board currently believes that Broadcom and itsour stockholders are best served by a Board leadership structure in which the roles of the CEO and the Chairman of the Board are held by different individuals, and that there be a Lead Independent Director if the Chairman is not independent. Under this structure, our CEO is generally responsible for setting theBroadcom’s strategic direction of Broadcom and for the day-to-day management of our operations. The independent Chairman and/or the Lead Independent Director, as applicable, provides strong independent leadership to assist our Board in fulfilling its oversight role of management and our risk management practices, approves the agenda for Board meetings and presides over Board meetings and over the meetings of our independent directors in executive session. Our Board annually reviews its leadership structure to determine whether it continues to best serve Broadcom and itsour stockholders. Currently, Mr. Tan serves as our President and CEO, Dr. Samueli serves as our independent Chairman of the Board and Mr. Hartenstein serves as our Lead Independent Director. As a result of the review, ourOur Board has decided thatto continue the current leadership structure and division of responsibilities should be continued.responsibilities.

In accordance with ourthe Corporate Governance Guidelines, our Board seeks individuals to serve as directors who have the highest personal and professional integrity, strength of character, demonstrated exceptional ability and judgment, and diversity of skills, experience and background appropriate for the business and operations of Broadcom.

When evaluating director candidates, the NESG Committee seeks to ensure that our Board has the requisite skills, experience and expertise, and that our Board consist of persons with appropriately diverse and independent backgrounds.

The NESG Committee will considerconsiders all aspects of a candidate’s qualifications in the context of the needs of Broadcom, including:

| | |  | | | 9 |

experience as a board member of another public company

The NESG Committee will consider nominee recommendations from its members, other Board members and members of our management, as well as nominees recommended by our stockholders. The NESG Committee has from time to time also engaged third-party search firms to assist in identifying and evaluating possible candidates.

See “Other Information –— Stockholder Proposals and Director Nominations for the 20232025 Annual Meeting” below for information on the requirements for director nominations, including nominations using proxy access.

DIRECTOR ATTENDANCE AND MEETINGS

of each committee on which the director is a member and the annual meetings of stockholders. Our Board held 11nine meetings during Fiscal Year 2021fiscal 2023 and our independent directors met at regularly scheduled executive sessions without management present. Each director attended at least 75% of the aggregate number of meetings of our Board and all committees of our Board on which the director served during Fiscal Year 2021. Our Corporate Governance Guidelines provide that each director is expected to attend the annual meetingsfiscal 2023. Eight of our stockholders. All ofnine directors then serving on our directorsBoard attended the 2023 annual meeting in April 2021.meeting.

BOARD EVALUATIONS

Our Board is committed to reviewing its performance through an annual evaluation process, which is overseen by the NESG Committee. Through the evaluations, our directors provide feedback on our Board and its committees and our Board assessesassess its processes and overall effectiveness. The Chairman of the Board and the Lead Independent Director report the results to our full Board and the ChairpersonsChairs of each committee report the results to their respective committees.

Our Board believes that evaluating Broadcom’s most critical risks is one of its most important areas of oversight. Our Board regularly reviews and discusses with management risks related to operations, liquidity, credit, cybersecurity, climate/environment,climate, compensation programs, workforce retention and senior management succession.

10 | | |  |

In addition, each committee is responsible for the oversight of specific areas of risk and reportreports regularly to our Board on matters relating to those risks. Management reports, at least annually, on our risks and risk management practices to the relevant committees and the full Board.

Committee | | | ||||||

Primary Areas of Risk Oversight | ||||||||

Audit | | |||||||

• | | | Oversee financial reporting process, accounting policies and internal controls | |||||

| | | • | | | Evaluate risks related to financial reporting, accounting, auditing, tax | |||

| | | • | | | Evaluate exposures and risks related to cybersecurity, data privacy and information technology | |||

| | | • | | | Review and approve related party transactions | |||

Compensation | | | • | | | Oversee compensation plans, programs and policies | ||

| | | • | | | ||||

| | | • | | | Evaluate and provide input on CEO and senior management succession planning | |||

NESG | | |||||||

• | | | Review and evaluate the corporate governance framework, including | |||||

| | | • | | | Evaluate the structure and composition of our Board and committees, including succession planning, | |||

| | | • | | | Oversee | |||

Cybersecurity Risk Management

Our Board is actively involved in overseeing our cybersecurity, data privacy and information technology risk management, with increased oversight on cybersecurity.management. Our management, including our Chief Information Officer, in consultation with our Chief Information Security Officer, reviews with the Audit Committee at least quarterly our cybersecurity, data privacy and information

technology security policies, practices and protective measures, current and projected threats to our data privacy and information security, cybersecurity incidents and related risks. Our Chief Information Officer also provides the Audit Committee at least quarterly an update on our enterprise security program that includes procedures and policies for testing vulnerabilities, responding to cybersecurity threats and providing a variety of cybersecurity, data privacy and incident response trainings to our employees. The Audit Committee and management also update our Board at least quarterly update our Board on our cybersecurity performance and risk profile and the effectiveness of our securitycybersecurity processes.

Compensation Risk Assessment

Our Board has the following committees: Audit Committee, Compensation Committee, NESG Committee and Executive Committee. The Audit Committee, the Compensation Committee and the NESG Committee each operate under a charter that satisfies the applicable standardsrules of the SEC and Nasdaq.the Nasdaq Stock Market (“Nasdaq”) listing standards. The charters for all four committees are available in the “Investor Center—Center — Corporate Governance—Governance — Documents” section of our website. Stockholders may also request a copy from Investor Relations, Broadcom Inc., 1320 Ridder Park Drive, San Jose,3421 Hillview Avenue, Palo Alto, California 95131.94304.

| | |  | | | 11 |

The current members and chairs of the committees are provided below.

| | | Committees | ||||||||||

Name | | | Audit | | | Compensation | | | NESG | | | Executive |

Diane M. Bryant | | | | |  | | | | | |||

Gayla J. Delly | | |  | | | | |  | | | ||

Raul J. Fernandez | | |  | | | | |  | | | ||

Kenneth Y. Hao(1) | | | | | | | | | ||||

Eddy W. Hartenstein (Lead Independent Director) | | | | |  | | |  | | |  | |

Check Kian Low | | | | |  | | |  | | | ||

Justine F. Page | | |  | | | | | | |  | ||

Henry Samueli, Ph.D. (Chairman of the Board) | | | | | | | | |  | |||

Hock E. Tan (President & CEO) | | | | | | | | |  | |||

Harry L. You | | |  | | |  | | | | |  | |

| | | Member | | |  | | | Chair |

| (1) | Mr. Hao has not been appointed to any committees. |

Audit Committee

Each member of the Audit Committee is independent in accordance with the audit committee independence requirements under the applicable rules and regulations of the SEC and Nasdaq. Our Board has determined that Mses. Delly and Page and Mr. You are audit committee financial experts under applicable SEC rules and have the requisite financial sophistication required by applicable Nasdaq rules.

Members | | | |||||||||

Primary Responsibilities | | | Meetings in Fiscal | ||||||||

| 2023 | |||||||||||

Justine F. Page (Chair) Gayla J. Delly Raul J. Fernandez Harry L. You | | | • | | | | | 8 | |||

| | • | | | Determine the appointment, compensation, retention, qualifications and independence of our independent registered public accounting firm | | | |||||

| | • | | | Conduct an annual performance evaluation of the internal audit function and independent registered public accounting firm | | | |||||

| | • | | | Oversee financial and operational risk, including any exposures and risks related to data privacy and information technology systems controls, cybersecurity and | | | |||||

| | • | | | Oversee compliance with legal, ethical and regulatory requirements | | | |||||

| | • | | | Establish procedures for the receipt, retention, investigation and treatment of complaints regarding accounting, internal controls and auditing matters | | | |||||

| | • | | | Review related party transactions | | ||||||

12 | | |

|

Compensation Committee

Each member of the Compensation Committee is independent in accordance with the compensation committee independence requirements under the applicable rules and regulations of the SEC and Nasdaq and is a non-employee director within the meaning of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Members | | | |||||||||

Primary Responsibilities | | | Meetings in Fiscal | ||||||||

| 2023 | |||||||||||

Harry L. You (Chair) Diane M. Bryant Eddy W. Hartenstein Check Kian Low | | | • | | | | | 5 | |||

| | • | | | Recommend to the independent directors | | | |||||

| | • | | | Design (in consultation with management or our Board) and evaluate compensation plans, policies and programs | | | |||||

| | • | | | Administer equity-based plans and approve the terms of | | | |||||

| | • | | | Confirm that compensation | | | |||||

| | • | | | Review and discuss, at least annually, the relationship between risk management policies and practices, business strategy and executive officers’ compensation | | | |||||

| | • | | | Establish and periodically review policies concerning perquisite benefits | | | |||||

| | • | | | Review and approve all employment agreements, severance and change-in-control arrangements and perquisites for executive officers and other executives | | | |||||

| | • | | | Evaluate and provide input on CEO and senior management succession planning | | | |||||

| | • | | | Review and make recommendations to our Board regarding compensation for non-employee directors | | | |||||

| | • | | | Establish and periodically review stockholder ownership guidelines | | | |||||

| | • | | | Provide oversight over the Compensation Committee’s compensation consultant | | ||||||

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee, Ms. Bryant and Messrs. Hartenstein, Low and You, are not and have never been officers or employees of Broadcom. During Fiscal Year 2021,fiscal 2023, none of our executive officers served on the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or the Compensation Committee.

| | | ||

| | | 13 |

Nominating, Environmental, Social & Governance Committee

Each member of the NESG Committee is independent in accordance with the applicable Nasdaq rules and regulations.

Members | | | |||||||||

Primary Responsibilities | | | Meetings in Fiscal | ||||||||

| 2023 | |||||||||||

Eddy W. Hartenstein (Chair) Gayla J. Delly Raul J. Fernandez Check Kian Low | | | • | | | | | 4 | |||

| | • | | | Identify, evaluate and recommend to our Board qualified director candidates | | | |||||

| | • | | | Assess director independence | | | |||||

| | • | | | Oversee the annual evaluation of our Board and its committees | | | |||||

| | • | | | Consider stockholder proposals submitted for consideration at the annual meeting of stockholders | | | |||||

| | • | | | Periodically assess director continuing education with respect to the business, financial statements, corporate governance and other appropriate subjects | | | |||||

| | | • | | | Periodically review and assess the Corporate Governance Guidelines and recommend changes to our Board | | | ||||

| | | • | | | Oversee Broadcom’s | | |||||

Executive Committee

The Executive Committee is comprised of our CEO, the Chairman of the Board and such other directors as our Board appoints.

Members | | | |||||||||

Primary Responsibilities | | | Meetings in Fiscal | ||||||||

| 2023 | |||||||||||

Henry Samueli, Ph.D. (Chair) Eddy W. Hartenstein Justine F. Page Hock E. Tan Harry L. You | | | Review and approve, subject to specified limitations: | | | 1 | |||||

| | • | | | investments, acquisitions, dispositions and capital expenditures | | | |||||

| | • | | | new or incremental debt financings or borrowings, or amendments thereto, or refinancings thereof, including convertible debt, bond financing and commercial paper | | | |||||

| | • | | | treasury, cash management and other banking matters | | | |||||

| | Review and provide recommendations to our Board on matters requiring full Board approval, | | | ||||||||

| | • | | | business opportunities, strategies and proposals, and other strategic matters | | | |||||

| | | • | | | business plans, annual budgets, targets, operational plans, capital structure and dividend policy | | | ||||

| | | • | | | proposed transactions that exceed | | | ||||

| | | • | | | efficient organization and management structure of Broadcom | | |||||

14 | | |

|

DIRECTOR COMPENSATION

On an annual basis, the Compensation Committee reviews our non-employee director compensation, with input from its independent compensation consultant regarding market practice and the competitiveness of our non-employee director compensation. Our Board approves any changes to our non-employee director compensation, taking into consideration the recommendations of the Compensation Committee and based on its own review. Our non-employee directors receive cash and equity compensation in consideration for their service on our Board, as set forth in more detail below, butbelow. Our non-employee directors do not receive any non-equity incentive compensation or participate in any company pension plan or deferred compensation plan.

In fiscal 2023, Dr. Samueli has declined all compensation, including equity awards, for his service on our Board and as its Chairman. However, we provideBeginning in March 2024, Dr. Samueli with accesswill receive cash and equity compensation provided to office space and administrative supportour non-employee directors as set forth below in connectionaccordance with the discharge of his duties as Chairman. The unvested equity awardsdetermination by our Board in December 2023 that we previously granted to Dr. Samueli during his tenure asis an employee of Broadcom continue to vest, subject to the terms and conditions of the awards.“independent” director. We also do not compensate Mr. Tan for his service on our Board or any committee of our Board.

Cash Compensation

Our non-employee directors are entitled to receive the following annual cash compensation, payable quarterly:quarterly, as of December 2022:

| Pay Component | Annual Fees | ||||

| Annual Retainer (payable to all non-employee directors) | $ | 90,000 | |||

| Additional Fees: | |||||

| Independent Chairperson of the Board | $ | 150,000 | |||

| Lead Independent Director | $ | 100,000 | |||

| Chairperson of the Audit Committee | $ | 40,000 | |||

| Chairperson of the Compensation Committee | $ | 22,500 | |||

| Chairperson of the NESG Committee | $ | 20,000 | |||

| Member of the Audit Committee (other than chairperson) | $ | 15,000 | |||

| Member of the Compensation Committee (other than chairperson) | $ | 10,000 | |||

| Member of the NESG Committee (other than chairperson) | $ | 10,000 | |||

Pay Component | | | Annual Fees |

Annual Retainer (payable to all non-employee directors) | | | $105,000 |

Additional Fees: | | | |

Independent Chairman of the Board | | | $150,000 |

Lead Independent Director | | | $100,000 |

Chair of the Audit Committee | | | $40,000 |

Chair of the Compensation Committee | | | $30,000 |

Chair of the NESG Committee | | | $25,000 |

Member of the Audit Committee (other than Chair) | | | $15,000 |

Member of the Compensation Committee (other than Chair) | | | $10,000 |

Member of the NESG Committee (other than Chair) | | | $10,000 |

Prior to the increase in the cash compensation paid to our non-employee directors in December 2022, the annual retainer was $90,000 and additional fees payable to the Compensation Committee Chair and the NESG Committee Chair were $22,500 and $20,000, respectively. All other fees remained unchanged.

In addition, we reimburse or pay non-employee directors for travel and other out-of-pocket expenses related to their attendance at Board and committee meetings, the annual meeting of stockholders and other Board-related travel undertaken at our request.

Equity Compensation

Our non-employee directors are also entitled to receive the following equity awards:

| | |  | | | 15 |

To determine the number of shares of Broadcom common stock granted pursuant to such awards, the value of the award is divided by the average of our per share closing market pricesprice quoted on the Nasdaq Global Select Market over the 30 calendar days immediately preceding the grant date. These service-based RSU awards vest in full on the earlier of (i) the first anniversary of the grant date or (ii) the date on which the annual meeting of stockholders immediately following the grant date is held, subject to the director’s continued service on our Board.

Director Compensation for Fiscal Year 20212023

The following table sets forth information regardingthe compensation earned by our non-employee directors during Fiscal Year 2021.fiscal 2023.

Name(1) | | | Fees Earned or Paid in Cash | | | Stock Awards(2) | | | Total |

Diane M. Bryant | | | $111,250 | | | $247,962 | | | $359,212 |

Gayla J. Delly | | | $126,250 | | | $247,962 | | | $374,212 |

Raul J. Fernandez | | | $126,250 | | | $247,962 | | | $374,212 |

Eddy W. Hartenstein | | | $235,000 | | | $247,962 | | | $482,962 |

Check Kian Low | | | $121,250 | | | $247,962 | | | $369,212 |

Justine F. Page | | | $141,250 | | | $247,962 | | | $389,212 |

Harry L. You | | | $144,375 | | | $247,962 | | | $392,337 |

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | Total | ||||||||

| Diane M. Bryant | $ | 100,000 | $ | 225,662 | $ | 325,662 | |||||

| Gayla J. Delly | $ | 115,000 | $ | 225,662 | $ | 340,662 | |||||

| Raul J. Fernandez | $ | 115,000 | $ | 225,662 | $ | 340,662 | |||||

| Eddy W. Hartenstein | $ | 232,500 | $ | 225,662 | $ | 458,162 | |||||

| Check Kian Low | $ | 110,000 | $ | 225,662 | $ | 335,662 | |||||

| Justine F. Page | $ | 130,000 | $ | 225,662 | $ | 355,662 | |||||

| Harry L. You | $ | 115,000 | $ | 225,662 | $ | 340,662 | |||||

| (1) | Mr. Hao is not listed as he was appointed to our Board in fiscal 2024. |

| (2) | Represents the grant date fair value of an RSU award for 397 shares of Broadcom common stock granted to the director on April 3, 2023 following his or her election to our Board and determined in accordance with Accounting Standards Codification Topic Number 718 (“ASC 718”), which is the closing price of Broadcom common stock on the date of grant, reduced by the present value of dividends expected to be paid on Broadcom common stock prior to vesting. |

Name | | | |||

Number of Shares Underlying RSUs | |||||

Diane M. Bryant | | 397 | |||

Gayla J. Delly | | 397 | |||

Raul J. Fernandez | | 397 | |||

Eddy W. Hartenstein | | 397 | |||

Check Kian Low | | 397 | |||

Justine F. Page | | 397 | |||

Harry L. You | | 397 | |||

16 | | |

|

ELECTION OF DIRECTORS

Our Board is currently comprised of nineten directors and our directors are to be elected each year at the annual meeting of stockholders. Mr. Hao was appointed to our Board in February 2024. As Mr. Fernandez is not standing for re-election, his term will end at the Annual Meeting and the size of our Board will be reduced to nine directors. Upon the recommendation of the NESG Committee, our Board nominated the nine individuals below for election as directors, all of whom are currently directors. Stockholders may not vote their proxies for a greater number of persons than the number of director nominees provided below.

Our Board expects that each of the director nominees will be available to serve as a director. Stockholders may not vote their proxies for a greater number of persons than the number of nominees named below.

In the event a director nominee resigns or otherwise becomes unwilling or unable to serve after the mailing of the Internet Notice but before the Annual Meeting, our intention would be to make a public announcement of such resignation and either reduce the size of our Board or appoint a substitute nominee, in accordance with our Amended and Restated Bylaws (the “Bylaws”). If we reduce the size of our Board, this would reduce the number of nominees to be elected at the Annual Meeting. Votes received in respect of such director would not be counted in such circumstances. In the event that we instead propose to elect a substitute nominee at the Annual Meeting to fill any such vacancy, it is intended that the shares represented by the proxy will be voted for such substitute nominee.

Our Board believes that each director nominee has the experience, qualification, personal and professionalqualifications, integrity, and diversity of background and understandsunderstanding of our business and industry. After careful consideration,industries required for service on our Board. Our Board, in consultation with the NESG Committee, also believes that each director nominee has demonstrated the willingness and the ability to dedicate adequatesufficient time and attention to fulfill the responsibilities required as a director and that theany service with other public companies does not and will not impact service on our Board. We also believe that the director nominees together have the skills

Director Qualifications, Skills, Experience and experience to form a board that is well suited to oversee the risks and opportunities facing Broadcom.Diversity

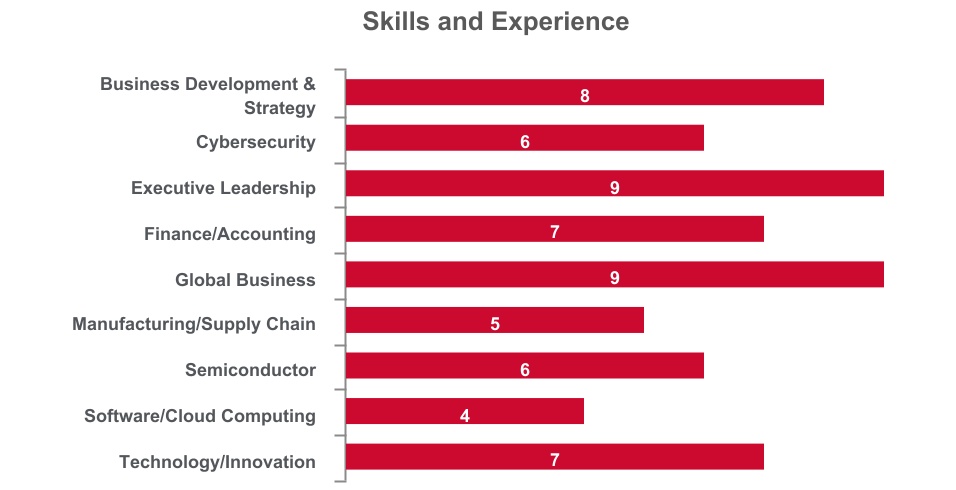

Qualifications & Skills | | | Bryant | | | Delly | | | Hao | | | Hartenstein | | | Low | | | Page | | | Samueli | | | Tan | | | You |

Business Development & Strategy | | |  | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | |

Cybersecurity | | |  | | | | |  | | | | | | | | | | | |  | | |  | ||||

Executive Leadership | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | |  |

Finance/Accounting | | | | |  | | |  | | |  | | |  | | |  | | | | |  | | |  | ||

Global Business | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | |  |

Manufacturing/Supply Chain | | |  | | |  | | | | | | | | |  | | |  | | |  | | | ||||

Semiconductor | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | | | ||

Software/Cloud Computing | | |  | | | | |  | | | | | | | | | | |  | | |  | |||||

Technology/Innovation | | |  | | |  | | |  | | |  | | | | | | |  | | |  | | |  | ||

Diversity | | | | | | | | | | | | | | | | | | | |||||||||

Gender | | | | | | | | | | | | | | | | | | | |||||||||

Female | | |  | | |  | | | | | | | | |  | | | | | | | ||||||

Male | | | | | | |  | | |  | | |  | | | | |  | | |  | | |  | |||

Ethnicity | | | | | | | | | | | | | | | | | | | |||||||||

African American or Black | | | | | | | | | | | | | | | | | | | |||||||||

Alaskan Native or Native American | | | | | | | | | | | | | | | | | | | |||||||||

Asian | | | | | | |  | | | | |  | | | | | | |  | | |  | |||||

Hispanic or Latinx | | | | | | | | | | | | | | | | | | | |||||||||

White | | |  | | |  | | | | |  | | | | |  | | |  | | | | | ||||

Two or More Races or Ethnicities | | | | | | | | | | | | | | | | | | | |||||||||

LGBTQ+ | | | | | | | | | | | | | | | | | | | |||||||||

Did Not Disclose | | | | | | | | | | | | | | | | | | |

| | |  | | | 17 |

The biographical information of each director nominee provided below is as of February 7, 2022.22, 2024.

Diane M. Bryant | ||||||||

Director Since: 2019 Independent Director | | | Board Committees: •Compensation | |||||

Ms. Bryant Ms. Bryant serves as a director of Haemonetics Corporation. She served as a director of United Technologies Corporation from January 2017 until its acquisition by Raytheon Company in April 2020. | | | • Business Development & Strategy • Cybersecurity • Executive • Global Business • Manufacturing/Supply Chain • Semiconductor • Software/Cloud Computing • Technology/Innovation | |||||

| Gayla J. Delly | |||||

Director Since: 2017 Independent Director | | | Board Committees: •Audit •NESG | ||

Ms. Delly served as Chief Executive Officer of Benchmark Electronics Inc., a company that provides contract manufacturing, design, engineering, test and distribution services to manufacturers of computers, medical devices, telecommunications equipment and industrial control and test instruments, from 2012 to 2016. She Ms. Delly | | | • Business Development & Strategy • Executive Leadership • Finance/Accounting • Global Business • Manufacturing/Supply Chain • Semiconductor • Technology/Innovation | ||

18 | | |  |

Kenneth Y. Hao | ||||||

Director Since: 2024 Independent Director Age: 55 | ||||||

| | Board Committees: • None | |||||

Mr. Mr. | | | Qualification & • Cybersecurity • Executive Leadership • Finance/Accounting • Global Business • Semiconductor • Software/Cloud Computing • Technology/Innovation | |||

| Eddy W. Hartenstein | |||||

Director Since: 2016 Lead Independent Director since 2018 | | | Board Committees: •Compensation •NESG (Chair) •Executive | ||

Mr. Hartenstein served as the publisher and Chief Executive Officer of the Los Angeles Times from 2008 to 2014. He was President and Chief Executive Officer from 2011 to 2013 and co-President from 2010 to 2011 of the Tribune Company. He was Chief Executive Officer from 2001 to 2004 and President from its inception in 1990 to 2001 of DIRECTV Inc. Mr. Hartenstein | | | • Business Development & Strategy • Executive • Finance/Accounting • Global Business • Semiconductor • Technology/Innovation | ||

| | |  | | | 19 |

Check Kian Low | |||||

Director Since: 2016 Independent Director | | | Board Committees: •Compensation •NESG | ||

Mr. Low has served as a founding partner and director of NewSmith Capital Partners LLP, an independent partnership providing corporate finance advice and investment management services, for which he manages the Asia Pacific offices, since 2003. He is an owner and director of Cluny Capital Limited Mr. Low served as a director of Singapore Telecommunications Limited from May 2011 to July | | | Qualification & Skills: • Executive Leadership • Finance/Accounting • Global Business | ||

| Justine F. Page | |||||

Director Since: 2019 Independent Director | | | Board Committees: •Audit (Chair) •Executive | ||

Ms. Page served as Vice President of Finance, Chief Financial Officer and Secretary of Integrated Circuit Systems, Inc. (“ICS”), a publicly-traded timing solutions IC company, from 1999 until its acquisition by Integrated Device Technology, Inc. Ms. Page served as a director of Broadcom Limited from 2016 to 2017, SunEdison Semiconductor Limited from 2014 to 2016 and Avago Technologies Limited from 2008 to 2016. | | | • Executive Leadership • Finance/Accounting • Global Business • Manufacturing/Supply Chain • Semiconductor | ||

20 | | |  |

Henry Samueli, Ph.D. | |||||

Director Since: 2016 Chairman of the Board since 2018 | | | Board Committees: •Executive (Chair) | ||

Dr. Samueli served as our Dr. Samueli served as Chairman and Co-Chairman of the | | | • Business Development & Strategy • Executive Leadership • Global Business • Manufacturing/Supply Chain • Semiconductor • Technology/Innovation | ||

| Hock E. Tan | |||||

Director Since: 2006 President & CEO | | | Board Committees: •Executive | ||

Mr. Tan has served as our President and CEO since March 2006. He was President and Chief Executive Officer at Integrated Circuit Systems, Inc. (“ICS”), a publicly-traded timing solutions IC company, from 1999 until its acquisition by Integrated Device Technology, Inc. (“IDT”) in 2005. He also Mr. Tan serves as a director of Meta Platforms, Inc. Mr. Tan was Chairman of the | | | • Business Development & Strategy • Cybersecurity • Executive • Finance/Accounting • Global Business • Manufacturing/Supply Chain • Semiconductor • Software/Cloud Computing • Technology/Innovation | ||

| | |  | | | 21 |

Harry L. You | |||||

Director Since: 2019 Independent Director | | | Board Committees: •Audit •Compensation (Chair) •Executive | ||

Mr. You served as Chief Financial Officer from September 2016 to August 2019 and President Mr. You Mr. You is also involved in the following special purpose acquisition companies that we believe do not require the same time commitment as an operating company. Mr. You has served as Chief Financial Officer since August 2023 and served as Co-Chief Executive Officer from March 2022 to March 2023 of dMY Squared Technology Group, Inc. Mr. You is Chairman of the | | | Qualification & Skills: • Cybersecurity • Executive Leadership • Finance/Accounting • Global Business • Software/Cloud Computing • Technology/Innovation | ||

Our Board recommends a vote FOR the election of each of the director nominees.

22 | | |

|

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee is responsible for the appointment, compensation, retention and oversight of the independent auditors retained to audit our consolidated financial statements. The Audit Committee has re-appointedreappointed PricewaterhouseCoopers LLP (“PwC”) as our independent auditorsregistered public accounting firm for Fiscal Year 2022.fiscal 2024. Our Board and the Audit Committee believe that the continued retention of PwC is in the best interests of Broadcom and our stockholders. We expect a representative from PwC to be present at the Annual Meeting. This representative will have the opportunity to make a statement if the representative so desires and is expected to be available to respond to appropriate questions.

Our stockholders are not required to ratify the appointment of PwC as our independent auditors. However, we are submitting the appointment of PwC to our stockholders for ratification as a matter of good corporate practice. In the event of a negative vote, the Audit Committee will reconsider whether or not to continue to retain PwC. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of Broadcom and our stockholders.

Set forth below are the fees for all services rendered by PwC to Broadcom for Fiscal Years 2021fiscal 2023 and 2020.2022.

| Fiscal Year 2021 | Fiscal Year 2020 | | | Fiscal 2023 | | Fiscal 2022 | ||||||||||||||

| ($ in thousands) | | ($ in thousands) | ||||||||||||||||||

| Audit Fees | Audit Fees | $ | 13,965 | $ | 16,131 | | $14,605 | | $14,505 | |||||||||||

| Audit-Related Fees | Audit-Related Fees | — | — | | — | | — | |||||||||||||

| Tax Fees | Tax Fees | 1,731 | 2,477 | | 1,386 | | 1,460 | |||||||||||||

| All Other Fees | All Other Fees | 24 | 79 | | | 10 | | 24 | ||||||||||||

| Total | Total | $ | 15,720 | $ | 18,687 | | | $16,001 | | $15,989 | ||||||||||

Audit Fees consist of fees billed for professional services provided in connection with the integrated audit of our annual consolidated financial statements, which includes an audit of internal controls over financial reporting, the review of our quarterly consolidated financial statements, and audit services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years, such as statutory audits, comfort letters and consents. The fees include audit fees related to business combination accounting for our recently closed acquisitions, inclusive of the acquisition of the Symantec Enterprise Security business in Fiscal Year 2020.

Tax Fees consist of fees billed for professional services for tax compliance and tax consulting. Corporate tax services encompass a variety of permissible services, including assistance with transfer pricing documentation, expatriate income tax matters, local tax compliance matters, tax audits, and tax credit documentation.

All Other Fees consist of fees for professional services rendered by PwC for permissible non-audit services. In Fiscal Years 2021 and 2020, these fees includedservices, which include services for various license andlicenses, compliance reviews and a license for specialized accounting research software.

In considering the nature of the services provided by PwC, the Audit Committee determined that the provision of these services is compatible with maintaining the independence of PwC. The Audit Committee discussed these services with PwC and our management to determine that they are permitted under the rules and regulationregulations concerning independent registered public accounting firms’ independence promulgated by the SEC, as well as by the American Institute of Certified Public Accountants.

Other than as stated above, no fees were billed to Broadcom by PwC for Fiscal Years 2021fiscal 2023 and 2020.2022.

| | | ||

| | | 23 |

AUDIT COMMITTEE PRE-APPROVAL OF SERVICES POLICY

All engagements with our independent registered public accounting firm, regardless of amount, must be authorized in advance by the Audit Committee. The Audit Committee has delegated its pre-approval authority to the Chairperson of the Audit Committee Chair, provided that any matters approved in such manner are presented to the Audit Committee at its next regularly scheduled meeting. Pursuant to the charter of the Audit Committee, committee approval of non-audit services (other than review and attest services) is not required, if such services fall within available exceptions established by the SEC. However, to date, the Audit Committee’s policy has been to approve all services provided by our independent registered public accounting firm. The independent registered public accounting firm and our management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with the Audit Committee’s pre-approval and the fees for the services performed to date.

During Fiscal Years 2021fiscal 2023 and 2020,2022, all services provided to Broadcom by PwC were pre-approved by the Audit Committee.

Our Board recommends a vote FOR the ratification of appointment of

PricewaterhouseCoopers LLP as ourthe independent registered public accounting firm

of Broadcom for Fiscal Year 2022.fiscal 2024.

24 | | |

|

The Audit Committee is responsible for assisting the Board with its oversight responsibilities regarding the following:

Fiscal Year 20212023 Financial Statements

In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed Broadcom’s financial statements for the fiscal year ended October 31, 2021 (“Fiscal Year 2021”)2023 with Broadcom’s management and PricewaterhouseCoopers LLP (“PwC”).PwC. In addition, the Audit Committee has discussed with PwC, with and without management present, Broadcom’s internal controls over financial reporting and the overall quality of Broadcom’s financial reporting. The Audit Committee also discussed with PwC the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

Based on the Audit Committee’s review and discussions noted herein, as well as such other matters deemed relevant and appropriate by the Audit Committee, the Audit Committee recommended to the Board, and the Board approved, that the audited financial statements for Fiscal Year 2021fiscal 2023 be included in Broadcom’sthe 2023 Annual Report on Form 10-K for Fiscal Year 2021 for filing with the SEC.

Independence and Pre-Approval Policy

The Audit Committee also received thea written disclosures and the letterreport from PwC required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed thewith PwC its independence of PwC with that firm.from Broadcom.

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by Broadcom’s independent registered public accounting firm. For each proposed service, PwC provides the Audit Committee with a description of the service and sufficient information to confirm PwC’s determination that the provision of such service will not impair its independence. The Audit Committee reviewed and pre-approved all audit and non-audit services performed by PwC during Fiscal Year 2021 in accordance with established procedures.fiscal 2023.

Independent Auditor Tenure and Rotation

As part of its auditor engagement process, the Audit Committee considers whether to rotate the independent audit firm. PwC has been Broadcom’s independent auditor since 2006. The Audit Committee believes there are significant benefits to having PwC as its independent auditor. These include:

The Audit Committee and the Board approved the selectionappointment of PricewaterhouseCoopers LLPPwC as Broadcom’s independent registered public accounting firm for the fiscal year ending October 30, 2022.

November 3, 2024.

AUDIT COMMITTEE

Justine F. Page, ChairpersonChair

Gayla J. Delly

Raul J. Fernandez

Harry L. You

| | | ||

| | | 25 |

ADVISORY VOTE TO APPROVE COMPENSATION OF

OUR NAMED EXECUTIVE OFFICERSOFFICER COMPENSATION

In accordance with the requirements of Section 14A of the Exchange Act, we are asking stockholders to approve, on an advisory basis, the compensation of our NEOs as described in the “Compensation Discussion and Analysis” and the compensation tables and accompanying narrative disclosure under “Executive Compensation” in this Proxy Statement. We currently hold the say-on-pay vote annually and expect the next say-on-pay vote will occur at the 20232025 annual meeting of stockholders.

Stockholders are being asked to approve the following resolution:

“RESOLVED THAT stockholders approve, on an advisory basis, the compensation of Broadcom’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and in the compensation tables and accompanying narrative disclosure under “Executive Compensation” in this Proxy Statement.”

In deciding how to vote on this proposal, stockholders are encouraged to read the “Compensation Discussion and Analysis” and “Executive Compensation” sections of this Proxy Statement.

While the vote on this resolution is advisory and not binding, the Compensation Committee and our Board values input from stockholders and will consider the outcome of the vote on this resolution when considering future executive compensation decisions.

Our Board recommends a vote FOR approval of

the compensation of our named executive officersofficer compensation on an advisory basis.

26 | | |  |

Our Board values open and ongoing engagement with our stockholders to develop a better understanding of our stockholders’ views on various matters, including executive compensation, succession planning, risk oversight and sustainability. Members of our Board engage annually with our stockholders to obtain their feedback and for our Board to consider a range of diverse perspectives.

Prior to the 2023 annual meeting, we contacted our stockholders representing 54% of common stock outstanding. Our Chairman of the Board, Lead Independent Director, Compensation Committee Chair and representatives from the Legal and Human Resources teams (the “management engagement team”) met with our stockholders representing 49% of common stock outstanding.

In these meetings, our stockholders primarily focused on the incremental PSU award granted to Mr. Tan in fiscal 2022 outside of his regular annual equity grant cycle to reward achievement of strategic priorities. Our stockholders provided feedback that they preferred this incremental PSU award have a performance period longer than one year and more disclosure on its pre-established performance metrics and determination of achievement. This initial feedback informed our Board and Compensation Committee in developing responsive actions to address the concerns of our stockholders.

After the 2023 annual meeting, we contacted our stockholders representing 53% of common stock outstanding and our Compensation Committee Chair and management engagement team met with our stockholders representing 52% of common stock outstanding to better understand the 32% support of the Say-on-Pay proposal at the 2023 annual meeting (the “2023 Say-on-Pay proposal”). Actions contemplated by our Board and Compensation Committee in response to the feedback received from the meetings prior to the 2023 annual meeting and the 2023 Say-on-Pay proposal vote results were discussed with our stockholders at these meetings.

In these meetings, our stockholders provided feedback that the main consideration behind their vote against the 2023 Say-on-Pay proposal was the incremental PSU award granted to Mr. Tan in fiscal 2022 for the reasons provided in the first round of meetings. Additional feedback obtained during these meetings included a request from several stockholders that we provide more explanatory disclosure regarding the determination of the executive officers’ individual multipliers for their annual cash incentive payouts. Several stockholders also requested more disclosure around the methodology and design of the PSU award granted to Mr. Tan and Dr. Kawwas in fiscal 2023, with more explanation on the PSU award granted to Mr. Tan as it was front-loaded to cover the market-based value of both his annual cash and long-term incentive opportunities over a period of five years to incentivize the achievement of our long-term growth strategy.

Throughout these meetings, our stockholders acknowledged our executive officers’ extraordinary performance in growing stockholder value. We also consistently heard from our stockholders that a commitment by our Board and Compensation Committee regarding special performance awards granted outside of the regular annual equity grant cycle and enhanced disclosure on the determination of the executive officers’ individual multipliers as provided below would directly address their concerns.

| | |  | | | 27 |

2023 SAY-ON-PAY VOTE AND OUR RESPONSE

What We Heard | | | Our Response |

Fiscal 2022 CEO Strategic PSU Award Most stockholders indicated the incremental PSU award granted to Mr. Tan in fiscal 2022 lacked adequate disclosure of the pre-established performance metrics and the determination of achievement. | | | Granting off-cycle special performance awards is not our typical practice. Our Board and Compensation Committee commit that, in the rare and exceptional circumstance a special performance award is considered for an executive officer, the award will: • be supported by detailed disclosure of the pre-established performance metrics and the determination of achievement, unless such disclosure would pose a competitive harm to Broadcom, and • include a performance period that is at least three years, unless our Board and Compensation Committee determine that a longer performance period would defeat the purpose of the award. |

Most stockholders expressed a preference for performance periods longer than one year for special performance awards. | | ||

Annual Incentive Plan Several stockholders requested additional explanatory disclosure on the determination of the individual multipliers for the executive officers’ annual cash incentive payouts. | | | We enhanced our disclosure in “Compensation Discussion and Analysis” to provide more information regarding the determination of the individual multipliers, including a summary of achievements that were considered for the final payout for each NEO. |

Fiscal 2023 CEO and NEO Kawwas PSU Awards Several stockholders requested additional disclosure on the methodology and design of the PSU awards granted to Mr. Tan and Dr. Kawwas in fiscal 2023. | | | Mr. Tan will not be eligible for annual cash incentive payouts during the five-year vesting period of his 2023 PSU award. Our Board does not intend to grant annual equity awards to Mr. Tan during the five-year vesting period of his 2023 PSU award. Our Compensation Committee does not intend to grant annual equity awards to Dr. Kawwas during the five-year vesting period of his 2023 PSU award. In “Compensation Discussion and Analysis,” we disclosed the methodology and design of the 2023 PSU awards granted to Mr. Tan and Dr. Kawwas, including the market-based value, structure and formidable stock price performance hurdles above the $470.12 closing stock price on the grant date. |

We believe these actions meaningfully address our stockholders’ concerns conveyed to us over two rounds of meetings regarding the 2023 Say-on-Pay proposal. Our Board and Compensation Committee remain committed to ongoing engagement with our stockholders to ensure that our executive compensation program continues to effectively support our strategic priorities, including market-leading stockholder value creation and the successful integration of VMware, and reflects the feedback provided by our stockholders.

28 | | |  |

The NEOs for our NEOs,fiscal 2023, who are our CEO, CFO and three other most highly compensatedonly executive officers, serving at the end of Fiscal Year 2021.

Hock E. Tan President and Chief Executive Officer |

Kirsten M. Spears Chief Financial Officer and Chief Accounting Officer |

Mark D. Brazeal Chief Legal and Corporate Affairs Officer |

Charlie B. Kawwas, Ph.D. President, Semiconductor Solutions Group |

In fiscal 2023, we achieved record revenue to $27,450 million, 15% above Fiscal Year 2020.

Total Stockholder Return and Return of Capital

Our TSR continues to Stockholderssignificantly outperform the S&P 500 and our compensation peer group. Over the five fiscal year period through 2023, we delivered TSR of 351% and our market capitalization increased from $103.6 billion to $346.0 billion.

| | |  | | | 29 |

| Dividend Increase YoY% | 23% | 11% | ||||||||||||

| | |  |

* TSR performance, based on anassumes $100 investment of $100 in Broadcom common stock on the last trading day of fiscal 2018 and reinvestment of dividends.

Financial Performance

* See Appendix A for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures.

EXECUTIVE COMPENSATION PROGRAM

Total Compensation Components

Our executive compensation program is designed to keep our fiscal year 2016, has been very strong on both an absoluteexecutive officers’ total compensation competitive with the compensation of executives in comparable positions at other companies in our compensation peer group. The Compensation Committee and relative basis. Although our one-year TSR increased significantly, wethe independent directors believe long-term TSRincentives are necessary to attract, motivate and retain our executive officers and to align the interests of our executive officers with the interests of our stockholders. As a result, the total target cash compensation (base salary and short-term incentives) for our executive officers is a more relevant measure, asgenerally lower than the median of the competitive market, but in combination with long-term incentives, the total compensation for our stock price over short periodsexecutive officers is frequently impacted by market volatility and macroeconomic events unrelated to our underlying performance.

30 | | |  |

Our annual total compensation for our executive officers consists of three principal components:

Component | | | Purpose & Description |

Base Salary | | | • Provide a level of fixed pay for stability and retention • Reflect scope, responsibilities and sustained individual performance • Set to be generally lower than the competitive market median in order to set the target value for PSU awards that results in target total compensation being higher than the competitive market median |

Short-Term Incentives (“STI”) | | | • Reward achievement of challenging and rigorous pre-established corporate financial goals based on revenue and adjusted non-GAAP operating income and divisional goals • Provide meaningful incentives to meet short-term (annual) objectives • Recognize individual contributions and performance |

Long-Term Incentives (“LTI”) | | | • Reward efforts to grow sustainable, long-term stockholder value • Encourage retention and mitigate compensation-related risks with stock ownership guidelines • PSU value awarded at above the competitive market median to incentivize achievement of challenging and rigorous performance goals |

Fiscal 2023 Total Compensation Components

The charts below compare the fiscal 2023 target total compensation for our CEO and our other NEOs.

Target total compensation consists of (i) base salary, (ii) target STI through the APB Plan and (iii) target LTI in the form of equity awards comprised of RSU and PSU awards based on the fair market value of the awards on the grant date, assuming target performance, as applicable.

As shown in the charts below, 96% of our CEO’s and 94% of our other NEOs’ average target total compensation in fiscal 2023 is comprised of variable compensation with a majority tied to stock price.

Compensation Philosophy and Objectives

Our executive compensation program is not based on a “one-size-fits-all” approach as Broadcom has transformed from a semiconductor company into a leading infrastructure technology company and operates in a highly competitive talent market. While the Compensation Committee and the independent directors believe attracting, motivating and retaining critical talent is crucial for Broadcom’s ongoing success, they also set challenging and rigorous short-term and long-term performance goals to incentivize our executive officers to continue achieving record financial results and increasing stockholder value. The philosophy and objectives below inform the design of our executive compensation program.

| | |  | | | 31 |

Pay-for-Performance

We encourage our Lead Independent Directorexecutive officers to focus on the achievement of our challenging and chairpersonrigorous corporate financial and operational performance goals and increase stockholder value. Executive officer base salaries reflect the performance of our executives, and we align our incentive compensation opportunities to the achievement of pre-established annual performance goals and long-term stockholder value creation, as well as the contributions and performance of each executive officer.

Alignment with Stockholders